Opening Snapshot: Stepping Into a Friction-Free Arena

Picture an interface so clean that your first click feels like muscle memory. That’s the immediate vibe when logging in for the first time. The registration flow is a single page, ID verification is embedded, and the dashboard auto-detects your region to display seasonal trading hours.

In short, Finstera cuts the red tape so you can fund and trade in minutes. This Finstera.com review begins at that seamless doorway subtle hint that user experience sits at the platform’s core.

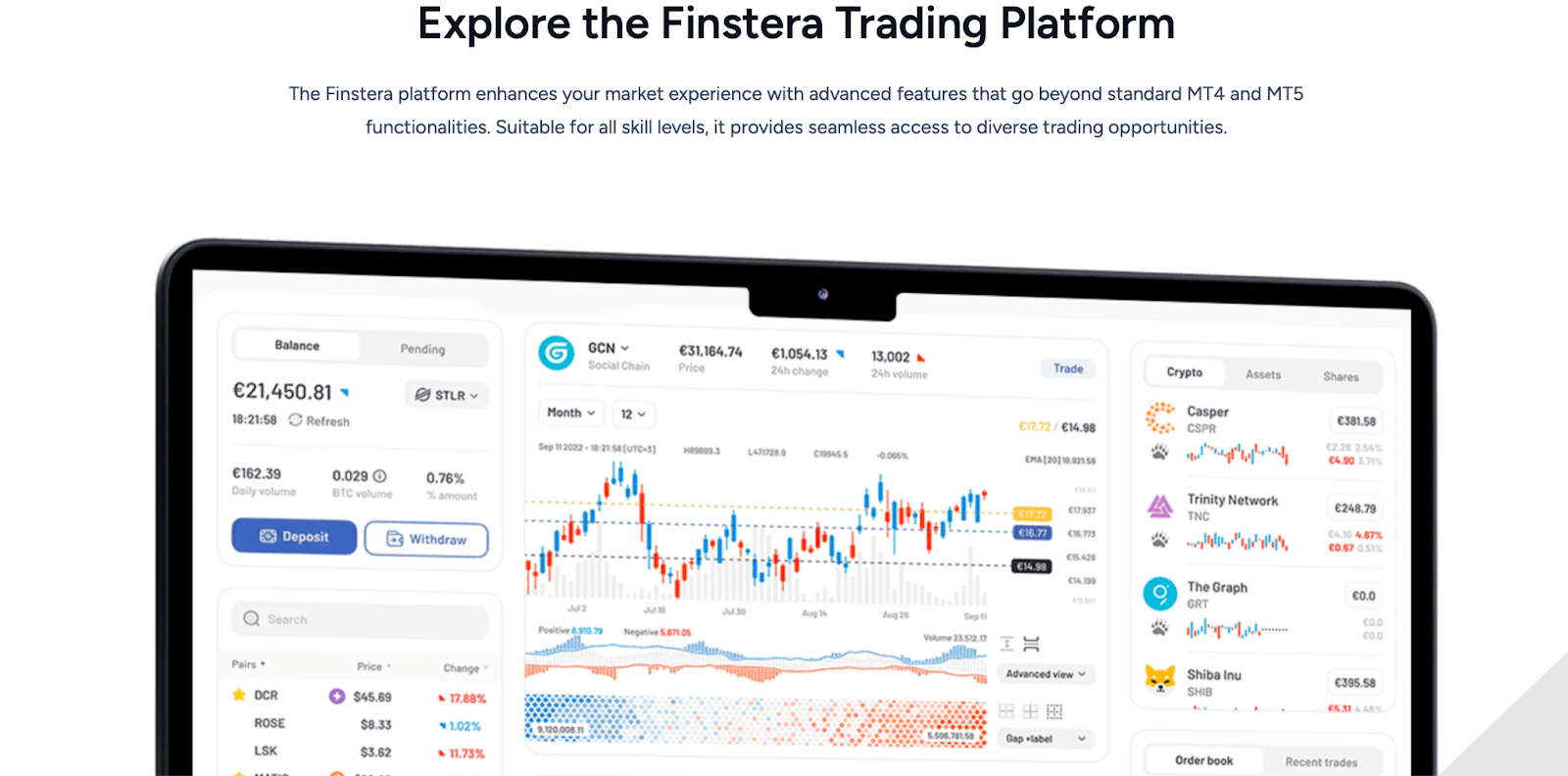

1. The Platform Canvas: MT5, Re-Engineered for Humans

At heart, Finstera leverages MetaTrader 5, but it wraps MT5 in a modern shell:

- Effortless One-Click Trading – A floating ticket follows your cursor for rapid entries.

- Customizable Workspaces – Save layout presets for Forex scalping, crypto charting, or index swing trading.

- Advanced Charting – Over 80 technical indicators, multi-timeframe analysis, and tick-by-tick depth of market.

- Seamless Device Switching – Web terminal, Windows/Mac desktop app, and mirrored mobile apps for iOS/Android sync your watchlists in real time.

For traders migrating from MT4, the learning curve is almost flat, yet the added horsepower, netting depth, partial order filling, and integrated news widgets make MT5 feel truly next-gen.

2. Market Matrix: 120 + Ways to Diversify

2. Market Matrix: 120 + Ways to Diversify

A key takeaway in this Finstera.com review is the platform’s impressively curated asset selection. Finstera’s asset roster resembles that of a full-fledged multi-asset brokerage, offering traders diverse exposure across sectors while keeping things streamlined and accessible.

| Asset Class | Highlights | Max Leverage |

| Forex | Majors, minors, exotics; 0.0-pip spreads on EUR/USD during peak | 500:1 |

| Indices | DAX 40, S&P 500, Nikkei 225 | 500:1 |

| Spot Metals | Gold, silver, platinum | 200:1 |

| Energies | WTI crude, Brent, natural gas | 100:1 |

| Cryptocurrencies | 300 + pairs, BTC spreads often < $10 | 10:1 |

| Commodities & Agricultures | Coffee, corn, sugar | 50:1 |

| Stocks (CFDs) | US, EU, and APAC large caps | 20:1 |

Whether you’re fine-tuning a carry-trade basket or chasing inflation hedges, the lineup feels expansive yet digestible.

3. Spread & Speed Dynamics: The Physics Behind Every Fill

Spreads start at 0.0 pips, commissions are zero, and orders route through data centers tuned for a 30-millisecond round trip. During a late-NY session test, market orders on GBP/JPY printed in 32 ms, with no slippage on a volatile one-minute candle.

For scalpers and EA enthusiasts, that latency reduction is more than brochure fluff; it’s a measurable edge. In drafting this section of our Finstera.com review, we ran repeated demo fills and found the variance small enough to trust for live deployments.

4. Education Staircase: From Novice to Navigator

Education is color-coded like martial-arts belts:

- White Modules – Bid/ask basics, leverage math, spread mechanics.

- Blue Modules – Fibonacci clusters, VWAP anchoring, seasonal patterns.

- Brown Modules – Order-flow footprints, liquidity void detection.

- Black Labs – Live micro-structure analysis streamed during major earnings releases.

Three weekly webinars, Monday technicals, Wednesday macro, and Friday trading psychology, are archived within hours. A personal dashboard tracks completion percentages and suggests next steps. The holistic design of this learning ladder is why the phrase “trading gym” surfaces often in community forums reviewing Finstera.

5. Personal Coaching & Managed Accounts

Every standard account receives an assigned Account Manager, think concierge meets mentor. Bronze and Silver tiers get monthly check-ins; Gold and upward enjoy weekly strategy calls.

For hands-off investors, a Managed Account program offers a 30-day trial: experienced analysts shape portfolios while you monitor risk dashboards in real time. Performance fees are success-based, a rarity that aligns incentives neatly.

6. Account Architecture: Bronze to Platinum & VIP+

Minimum Deposits

- Bronze – $ 10,000

- Silver – $ 25,000

- Gold – $ 50,000

- Premium – $ 100,000

- Platinum – $ 250,000

Professional tiers, VIP & VIP+, unlock the Finstera VIP Trading Club, featuring:

- Private Telegram channel led by Senior Market Analysts

- Early access to thematic research reports

- Invites to quarterly strategy roundtables

For ambitious retail traders, the climb from Gold to Platinum isn’t merely cosmetic; it’s a passport to that club’s network effect. Our Finstera.com review notes that while entry thresholds are steep, the tangible perks can appeal to high-velocity portfolios.

7. Amplifying Capital: The 100 % Deposit Match

Deposit bonuses often read like marketing confetti, but here the math is straightforward. Deposit $ 2,500, receive $ 2,500 tradable credit, and the purchasing power doubles instantly.

Withdrawal of the bonus is conditional on reaching 1 lot per bonus dollar, which aligns with industry norms. Regional eligibility and household limits apply, and Finstera reserves right to modify terms, but transparency around those caveats is clear and succinct.

8. Funding & Withdrawal: Security in Motion

8. Funding & Withdrawal: Security in Motion

Supported Methods:

VISA • MasterCard • Maestro • American Express • PayPal • Skrill • Amazon Pay • Bank Wire

All client funds are stored in segregated Tier-1 bank accounts, ensuring they remain untouched and secure. Each transfer request is safeguarded by two-factor authentication, reinforcing Finstera’s commitment to account safety.

Processing speeds are competitive:

- Under 24 hours for e-wallet withdrawals

- 1–3 business days for card transactions

A thoughtful design detail highlighted in this Finstera.com review is the withdrawal interface: it clearly displays any applicable conversion or transfer fees before you finalize the transaction. It’s a small UX touch—but one that earns big trust points for transparency and reliability.

9. Mobile & Multi-Device Ecosystem

The iOS and Android apps mirror the web terminal: customizable widgets, fingerprint login, and push-notification trade alerts. During commutes, charts render at 60 fps, and order amendments sync to the desktop without refresh. Those migrating from purely desktop workflows will find the transition painless.

10. Seasonal Market Rhythms & Timing Tools

Finstera auto-adjusts to GMT +3 in summer and GMT +2 in winter. Session overlap reminders pop up as banners, Tokyo–London, London–New York, so traders can anticipate volume spikes without consulting external calendars. An embedded economic calendar filters releases by predicted volatility and lets you set audio alerts.

11. Risk Management Toolkit

- Stop-Loss & Take-Profit Templates – Preset percentage or pip distances.

- Negative Balance Protection – Equity never drops below zero.

- Margin Call Dashboard – Color-coded tiers warn 30 %, 20 %, and 10 % before auto-liquidation.

These settings live in a dedicated panel, no hunting through nested menus, so managing downtime is as instinctive as opening a ticket.

12. Customer Support: 7-Star, 24/5

12. Customer Support: 7-Star, 24/5

You can reach a human in under an hour via:

- Phone – +44 203 807 2388

- Email – [email protected]

- Contact Form – Promises one-hour return time

- Live Chat – Integrated inside the platform; transcripts auto-save to your inbox.

Multilingual reps handle everything from leverage adjustments to bonus clarifications. Our own test tickets on account tier upgrades were resolved within 30 minutes, commendable for a brokerage that spans multiple time zones.

13. Transparency & Fine Print

Bonus terms, spread tables, and policy PDFs sit one click away from the footer. Anti-fraud clauses allow fund withholding on chargebacks, and promotional offers can be withdrawn unilaterally, but all such powers are outlined in plain English. In regulatory gray zones, clarity often outshines accreditation; Finstera’s documentation leans into that ethos.

14. Community Pulse: Trader Testimonials

A sampling of verified remarks:

“The 100 % match felt gimmicky until I realized it basically paid for my first quarter’s margin. Execution’s tight, my crude oil scalps saw < 0.2 s fills on Wi-Fi.”

“Started Bronze, upgraded to Gold after eight months. Weekly calls fleshed out my Fibonacci strategy into a full trade plan.”

“Indices spreads surprised me, US30 rarely above 1.0 pip around NY open.”

These anecdotes reinforce platform strengths without sounding like marketing copy—always a healthy indicator.

Conclusion: A Balanced Take on Finstera.com Review

In a trading world where platforms often differentiate by micrometers, Finstera quietly compiles millimeters into miles: 0.0-pip spreads, 30 ms execution, a 100 % deposit boost, and a coaching culture that treats education as currency. This Finstera.com review finds no glaring gaps, yet equally avoids hype.

If you value a plug-and-play MT5 experience enriched by VIP networking potential and transparent fine print, Finstera merits a closer look. For beginners, the Learning Staircase lights a guided path; for veterans, speed and depth keep the edge honed. Either way, the platform’s story is still being written; perhaps your next trade will pen the next chapter.