Bitcoin (BTC) is the most well-known and valuable cryptocurrency in the world. Since its inception in 2009, Bitcoin has not only revolutionized the digital currency space but has also become a popular investment asset across the globe. For anyone involved in crypto trading or investment, keeping a close eye on the Bitcoin price USD is essential. In this article, we’ll explore the current BTC price trends, real-time chart data, market cap, and recent developments influencing the cryptocurrency market.

Understanding Bitcoin Price in USD

The Bitcoin price in USD reflects how much one Bitcoin is worth in United States Dollars. As the world’s reserve currency, the USD is the most commonly used benchmark to evaluate Bitcoin’s price. It provides a consistent metric for traders, investors, and enthusiasts to assess the performance and value of Bitcoin across various exchanges.

Bitcoin’s price is highly volatile and can change significantly in minutes. This fluctuation is driven by several factors, including market demand, investor sentiment, global news, regulation changes, and overall adoption of cryptocurrency technology.

Real-Time BTC Price Charts

Real-time BTC price charts allow users to view live data on Bitcoin’s performance. These charts typically include:

- Live Price: Shows the current market price of Bitcoin in USD.

- Price Movement: Graphs showing historical price trends over time (e.g., 24h, 7d, 30d, 1y).

- Volume: The amount of Bitcoin traded during a specific period.

- Market Cap: The total value of all Bitcoins in circulation, calculated by multiplying the current price by the circulating supply.

These charts help traders make informed decisions by analyzing patterns and spotting trends, such as price breakouts or dips.

What Affects the Bitcoin Price?

- Market Supply and Demand:

- Bitcoin has a fixed maximum supply of 21 million coins. As the supply decreases and demand increases, the price tends to rise.

- Macroeconomic Factors:

- Inflation rates, interest rate policies, and geopolitical events can influence Bitcoin’s appeal as a hedge or speculative investment.

- Investor Sentiment:

- Market confidence can be affected by influential investors, institutional involvement, or social media trends.

- Regulatory News:

- Government policies and regulations around cryptocurrencies significantly affect BTC prices. Positive developments often boost prices, while restrictions can cause declines.

- Technological Developments:

- Upgrades to the Bitcoin network or related blockchain technologies can influence long-term price expectations.

Bitcoin Market Cap and Its Importance

The market cap of Bitcoin provides insight into the overall size and strength of the cryptocurrency. It’s calculated using the formula:

Market Cap = Current Price x Circulating Supply

For example, if Bitcoin is priced at $65,000 and there are 19 million Bitcoins in circulation, the market cap would be:

$65,000 x 19,000,000 = $1.235 Trillion

A higher market cap generally means more trust and adoption. It also makes Bitcoin more stable compared to smaller cryptocurrencies, though it still remains volatile compared to traditional assets.

Latest Bitcoin News and Developments

Keeping up with the latest Bitcoin news is crucial for understanding price changes. Key news stories may include:

- Institutional Adoption: Companies like Tesla, MicroStrategy, and PayPal investing in or accepting Bitcoin.

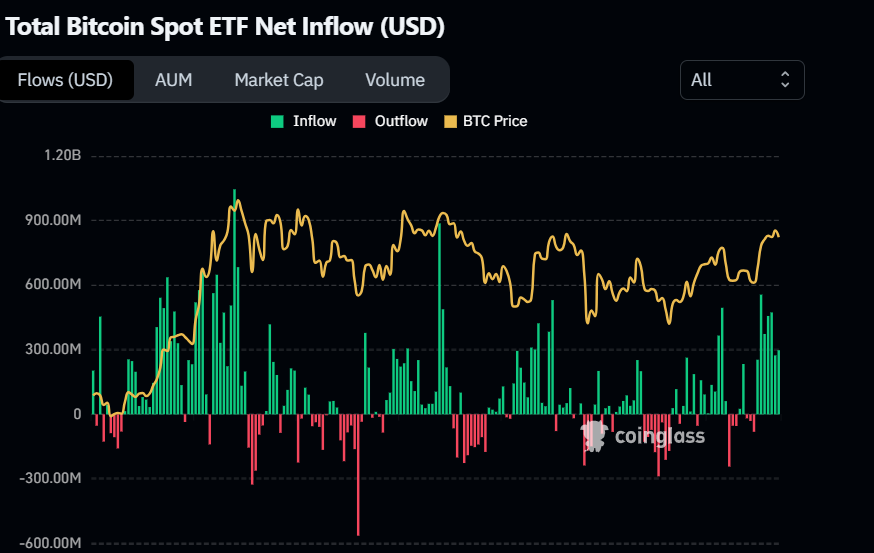

- ETF Approvals: The launch of Bitcoin ETFs (Exchange-Traded Funds) can boost mainstream adoption.

- Mining Regulations: Countries like China and the U.S. affect Bitcoin mining operations through energy policies and regulations.

- Technological Innovations: Developments like the Lightning Network or Taproot upgrade can improve Bitcoin’s utility and performance.

News updates can have an immediate impact on price movements. Staying informed helps investors make strategic decisions.

Why Monitor Bitcoin Price in USD?

Tracking the Bitcoin price in USD is important for several reasons:

- Global Relevance: The USD is the standard global currency, making it easier to compare BTC prices across platforms.

- Trading Decisions: Traders use USD to measure profit and loss.

- Investment Strategy: Long-term investors use price trends to decide when to buy, sell, or hold.

Whether you’re an experienced investor or just getting started in crypto, monitoring BTC/USD can help you navigate the market with confidence.

Conclusion

Bitcoin remains at the forefront of the digital asset revolution. By staying updated with the Bitcoin price in USD, understanding market cap, analyzing live charts, and following relevant news, investors can make more informed and strategic decisions. Platforms like Bitget provide comprehensive tools and data to track real-time Bitcoin performance, empowering users to stay ahead in the fast-paced world of crypto.